First of all: in my work as a management consultant in the life science sector, I inevitably deal with the question of what the future of the industry will look like on a daily basis. This is the only way my colleagues and I can advise our clients as comprehensively and sustainably as possible. In my search for answers to this question, I came across the study conducted by Steinbeis Hochschule1 together with Pro Generika, which is the basis for the thoughts and explanations surrounding this article.

When the future can be planned.

The word "future" is usually used in the singular, which at first suggests that there is only one possible future towards which we are heading. However, the example discussed here makes it clear that several future variants are conceivable at the present time. In the case of the generics and biosimilars industry, there are at least four possible variants, which will be briefly presented here and explained in more detail in the second part of the article.

In general, our future can be planned or at least influenced up to a certain point. However, only if enough time is invested in expert hypotheses, trend analyses, experience reports and technology research. This commitment and painstaking work then provide a more or less clear picture. On the basis of figures, data and facts, it is possible to deduce what the future may look like and where we are likely to be in a few years' time.

Great upheavals are not uncommon in history.

Already more than 100 years ago, the British natural scientist Charles Darwin proved that only those species survive that are best able to adapt to a new environment with new framework conditions. However, this theory of the "Survival of the Fittest" can not only be applied to living creatures such as dinosaurs or the Neanderthal man, it can also be applied and regularly observed in companies and even entire industries.

The Scandinavian mobile phone manufacturer Nokia is one such example. In the 2000s, Nokia was a leader in the production of mobile phones. Then it missed the trend towards smartphones and fell into oblivion within a very short time. A similar thing happened to an entire industry: video stores. They, too, have completely disappeared from the scene. Netflix, Amazon Prime and Magenta TV are the video stores of the 21st century. And yes, it was more or less predictable.

The generics industry is facing a change.

It is currently becoming apparent that the successful model of generic drug manufacturers is also facing some major challenges and hurdles. The industry is facing a so-called change. The authors of the Chair of Futurology at Steinbeis University, who set up and painstakingly prepared this study together with their research partner Pro Generika, speak here of so-called killer innovations that can ruin entire industries.

The study entitled "The Future of the European Generics and Biosimilars Industry 2030plus" is based on a central Delphi survey of industry experts, 61 in total, from areas such as generics and biosimilars, biotech, but also doctors, wholesalers, pharmacists, health insurance companies as well as consultancies or researchers and scientists from laboratories, clinics, universities and institutes. The authors from Steinbeis University summarise the core results from the study and the experts as follows:

A plan B is absolutely necessary.

Anyone who only pursues a plan A without an alternative, i.e. who does not have an option B, will almost certainly be caught on the wrong foot by the future at some point. A hypothesis from the field of generic drug manufacturers that will probably become fact in the future is: innovate instead of just copying with probably a much more digitally designed business model. Copying is no longer enough, innovation will be necessary. Plus: the business model will probably have to become much more digital in order to survive.

Manufacturers do not take 3D printing seriously enough.

The most frequently mentioned argument in the generic segment is price. Many experts are of the opinion that generics and biosimilar manufacturers will always exist and that there must be a cost-effective alternative in the health care system. Almost like the Amen in the church.

But what happens when, all of a sudden, further technological quantum leaps make originator products almost as cheap as generics?

Another group of experts says that as soon as 3D printing is ready for the mass market, almost all conventional production will collapse anyway. The sceptics, on the other hand, say that 3D printing will never become mass-market ready.

But sceptics have also said that about other things. For example, do you have a laptop or a computer at home today? If so, then you see how fast it can go. A few decades ago, the consensus among many experts was that the computer would never be available for the home, for the general public. Nowadays, it's hard to imagine life without laptops. You see them not only on desks, but also on planes, trains or on the deck chair on holiday.

The Covid-19 learning effect.

Covid-19 should have been a hello-wake-up effect for many companies, but how many have actually learned from it and drawn the right conclusions? The federal government can be used as a negative example: it has not managed to reasonably equip our future achievers, our students, for home schooling, let alone develop solid concepts for on-site instruction, neither in summer 2020, nor in spring 2021. The pharmaceutical industry now has to think about a similar number of things. Artificial intelligence in risk analysis and management, flexible strategies in procurement such as multiple sourcing, value collaboration and strategic cooperation with suppliers as well as sustainable supplier audits. These are all points that need to be considered as soon as possible. The goal: a robust and flexible supply chain in the pharmaceutical industry.The industry underestimates BigTech.

Buzzwords like digitalisation, digital health, Pharma 4.0 or Industry 4.0 in general are now even used by our politicians in almost every interview to suggest that they are looking ahead. For some, that may even be true, but what does that actually mean in concrete terms? Some BigTech companies are now showing how it can be done. And not because they produce better or cheaper. No! Because they are better at collecting numbers, data and facts and then evaluating them. Fact-based discussions and complete transparency of the data landscape are the best decision drivers in the 21st century. The most prominent example is Amazon Pharmacy. The future belongs to those who have the data.

The future does not have only one variant.

There is not just "one future" - but at least four. Because: Anyone who backs only one horse or believes that there is only one variant of the future is practically always wrong. In the following, four scenarios are presented and discussed in more detail in the second part of this blog article. Which variants are conceivable:- Regulators are disrupting the industry

- The platforms occupy the market

- The industry is migrating

- Digital Health revolutionises the market

More on this and a detailed description in the second part of this blog. Before taking a closer look at the four scenarios mentioned above or talking about further results of this excellent study prepared by Steinbeis University, one should first look at some interesting key figures.

An overview: Key data and key figures of the market (2-7).

An overview: Key data and key figures of the market (7-13).

As can be seen in the illustrations above, coping with the future will be anything but easy. But preparations can be made. A return of the pharmaceutical industry to Europe is associated with rising prices. The Covid-19 pandemic has exposed the pain points, constraints and vulnerabilities of pharmaceutical supply chain management. More robust supply chains and procurement efforts, equipped with more digital solutions and better connected, are mandatory. Research and development spending and initiatives are well invested, but at the end of the day, it has to be produced and delivered to the population.

Experts' assessment.

Dr. Thomas Strüngmann, co-founder of the pharmaceutical company Hexal from Holzkirchen in Upper Bavaria and BioTech investor, gave the following assessment in an interview on the future of the generics and biosimilars industry:

"The speed at which the generics and biosimilars market will develop, and thus its future, is difficult to predict. My experience is that development in the pharmaceutical market is rather slow compared to other industries. For example, I had long predicted pharmacy chains for Germany. We still don't have them today."

The generic market is increasingly dominated by the health insurance funds, for example in Germany, or the trade, i.e. pharmacies and digital platforms. This is happening with increasing price pressure. The average tablet price in Germany is six cents. It is only a matter of time before Amazon and other technology giants also enter the pharmaceutical market.

The biosimilars market is following suit.

The biosimilars market is only at the beginning of its development. However, there will be equally fierce price competition here in the future. German politicians have already announced that biosimilar tenders can also be expected in the next two years. Technology will not be the big driver of change in the generics and biosimilars industry, because a generic must be as "similar" to the original as possible. This means that "old" technologies are in demand. What will most likely be available in the future, however, are further developments of generics. Based on the substances, further dosage forms can be developed with the help of new technologies."2

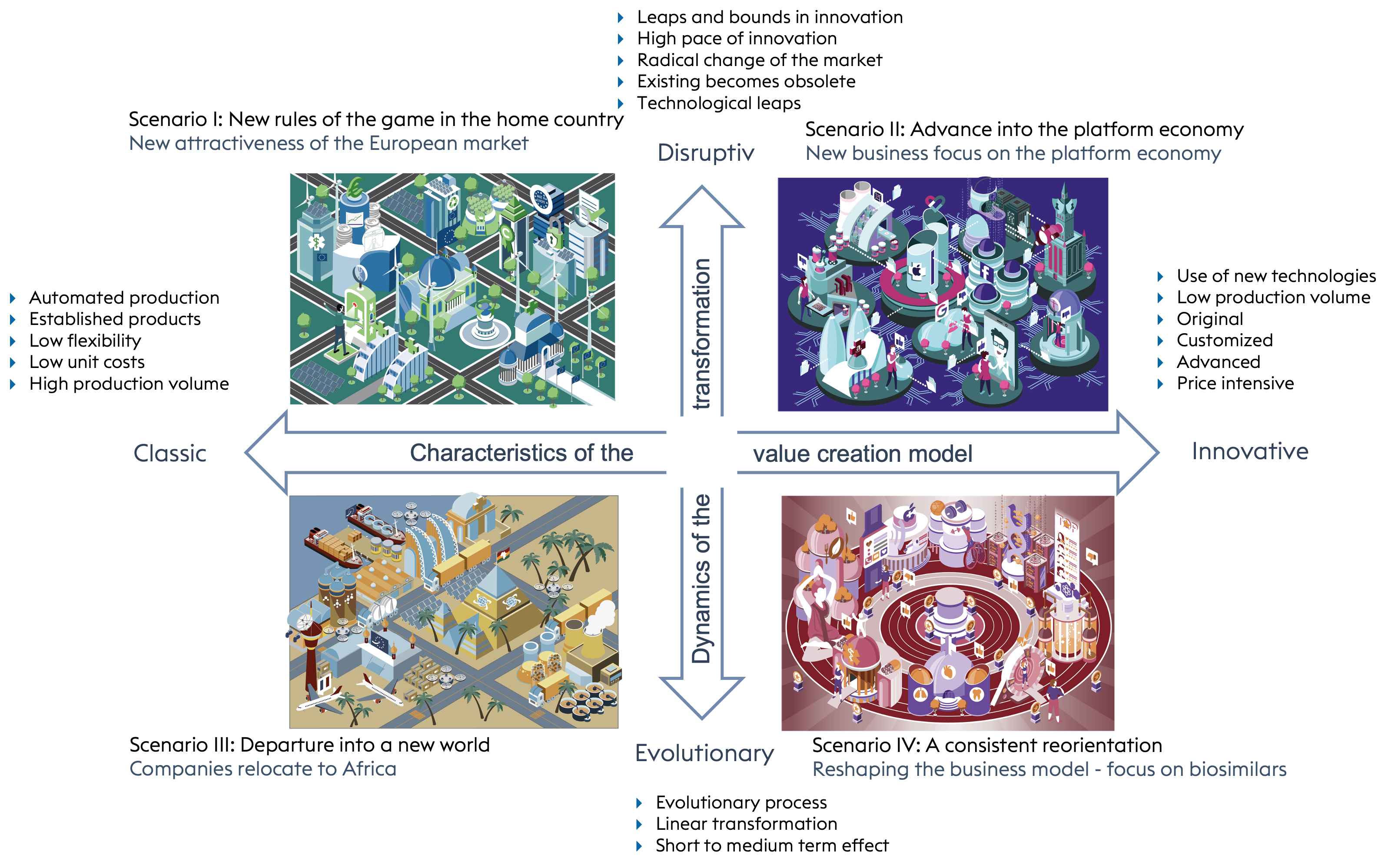

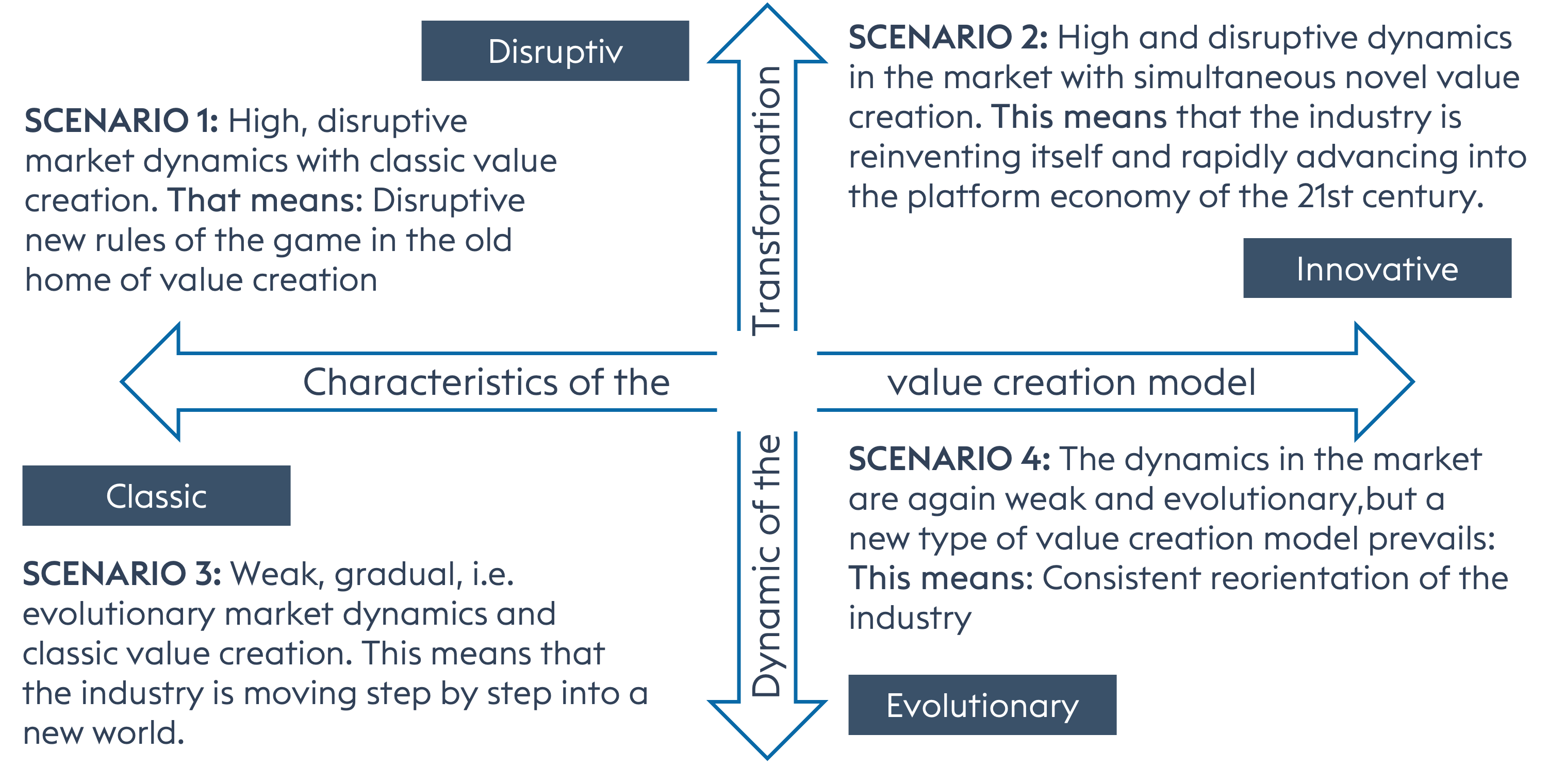

But now, as announced in Part 1 of the blog, more about the four possible scenarios 2030 plus. Based on the Delphi expert survey, the following four pictures of the future were created using the so-called scenario technique. The technique produces not just one picture of the future, but four. This avoids the fejöer that most people make when they form a picture of the future. For a single image can quickly err. The four scenarios are taken from the four-quadrant diagram that is commonly used. This method of representation is not only clear, but also plausible in terms of content.

Two variables were chosen to set up the four scenarios:

- On the one hand, the dynamics of the sector's development

- On the other hand, the way in which value is created in the industry

Enclosed now is the 4-quadrant chart with the four scenarios mentioned above.

As soon as these two variables have been selected, the following four future scenarios result purely combinatorially, as sketched in Figure 1-2.4

The characteristics of the four variants.

Each of the variants has its own characteristics. In scenario 1, with high, disruptive market dynamics but a classic value creation model, we are confronted with new rules of the game in the old home.

Scenario 2 also shows a high level of dynamism, but at the same time with new types of value creation. The industry is reinventing itself and the business focus is on the so-called platform economy.

In scenario 3, we are talking about weak but evolutionary market dynamics with classic value creation. The industry is setting out into a new world. Companies are relocating to Africa.

Scenario 4 is again characterised by weak but evolutionary market dynamics. Nevertheless, a novel value creation model prevails. It is about a consistent reorientation, namely the reshaping of the business model with a focus on biosimilars.

The characteristics of the four poles:

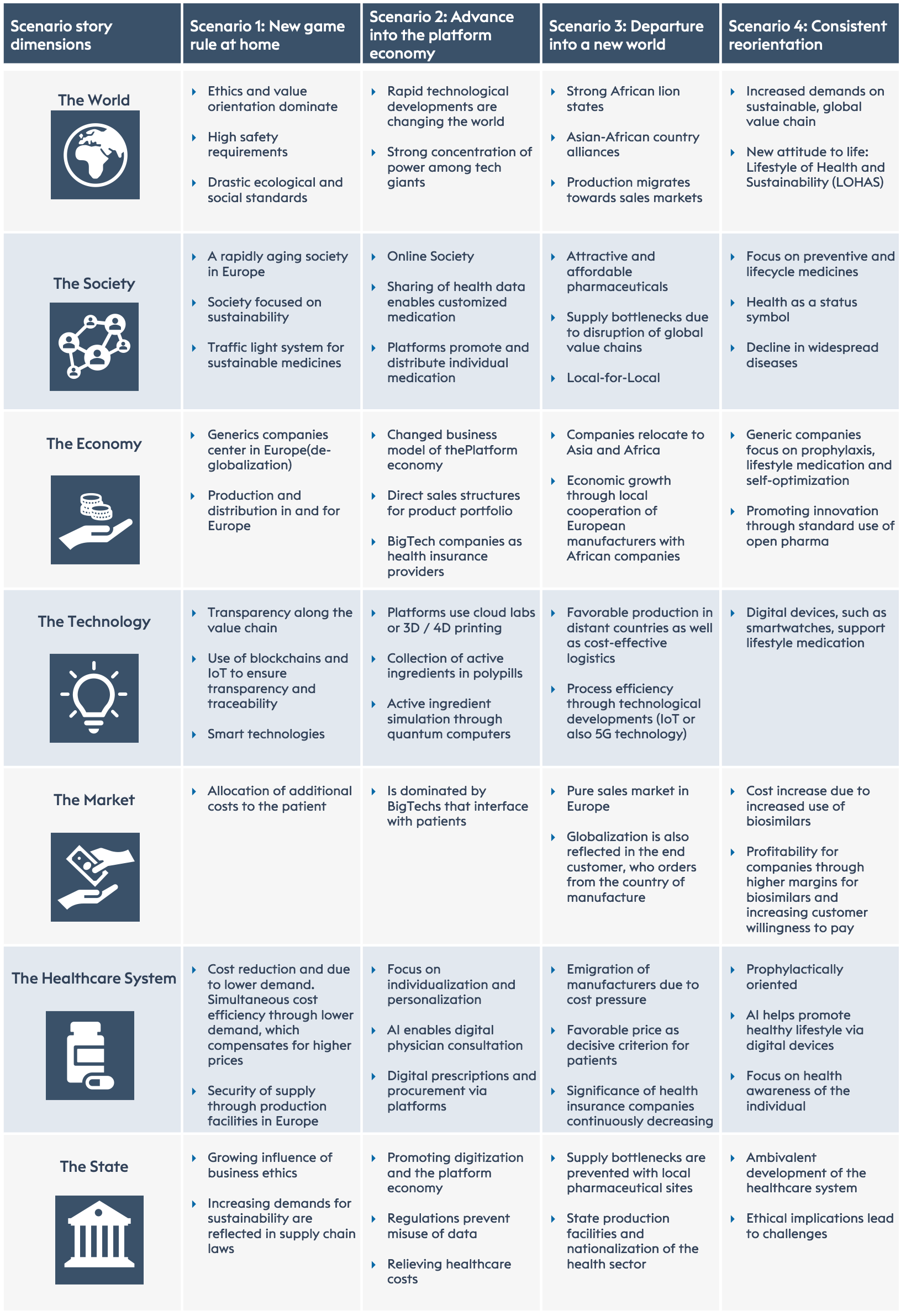

What happens in the four scenarios? A total of seven dimensions can be considered, which are briefly presented below:

The seven dimensions are: 1) world; 2) society; 3) economy; 4) technologies; 5) market; 6) health system and 7) state.

The characteristics of the four poles within 7 dimensions.

Finally, two short assessments by CureVac founder Dr Ingmar Hoerr and partner and Head of Life Sciences and Chemicals Thomas Hillek at KPMG Wirtschaftsprüfungsgesellschaft.

Dr Ingmar Hoerr:5

How does he assess the future of the pharmaceutical industry described in the scenario, especially the generics and biosimilars sector?

"We are currently in the midst of a major paradigm shift. The individualisability of medicine no longer refers only to preventive medical care, but rather also to the medication of patients. At CureVac, we are already working together with Tesla on a mobile RNA printer, which makes it possible to produce active substances all over the world. The whole thing can be imagined as a clean room laboratory the size of a container.

I see large technology companies playing a supporting role in this scenario. Especially with a view to individual therapy, the printing business model is very compatible with that of Amazon, for example. I only see generic and biosimilar companies entering RNA printing in the very long-term future. The companies' business model usually starts when the patent protection of drugs expires. Exactly the same would apply to RNA printers. So in principle, I see it as absolutely realistic that such a scenario will occur. However, I cannot say exactly when."

Thomas Hillek:6 What influence will a development towards the platform economy have on the generics and biosimilars industry?

"The increasing trend towards the platform economy and e-commerce, exacerbated by the Covid-19 pandemic, will present the biosimilar and generics industry with a choice in the future: Either the companies themselves invest in their own sales and customer platforms or they enter into close cooperation models with the big tech giants.

In this context, it will be essential for companies to increase their adaptability. Biosimilars and generics manufacturers will have to become much more agile and digital, and align their products and services with customer needs.

A thoroughly networked enterprise - Connected Enterprise - is required. This is connected to all stakeholders in the health system and puts the customer at the centre. For this, all parts of a company must be organised cross-functionally and work closely together internally and externally. Especially with the rapid digitalisation in the pharmaceutical industry, a cross-functional data strategy and associated, overarching data management capabilities are essential."

Literature.

- [1-6] Heike von der Gracht, Stefanie Kisgen, Nick Lange and Jessica Jalufka, SIBE GmbH, Steinbeis University of Applied Sciences, Kalkofenstraße 53, 71083 Herrenberg, Steinbeis-Edition, Stuttgart, 1st edition, 2021, ISBN: 978-3-395663-175-7.

- Heike von der Gracht, Stefanie Kisgen, Nick Lange and Jessica Jalufka, SIBE GmbH, Steinbeis University of Applied Sciences, Kalkofenstraße 53, 71083 Herrenberg, Steinbeis-Edition, Stuttgart, 1st edition, 2021, ISBN: 978-3-395663-175-7.

- https://www.medgadget.com/2020/08/generic-drugs-market-report-price-size-share-and-forecast-2020-25.html, retrieval date 21.11.20

- Transparency Market Research (2015): ePharmacy Market (By Geography - North America, Europe, Asia Pacific, Middle East, and Africa, Latin America) - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2015 - 2023, www.transparencymarketresearch.com/epharmacies-market.html, accessed 21.11.20.

- Formycon AG. (2021): Biosimilars, available at https://www.formycon.com/biosimilars/biosimilars/, retrieval date 15.11.20.

- Laboulle, L. (2019): In last place EU-wide: In Luxembourg, the market share of generic medicines is only 5 per cent. available at https://www.tageblatt.lu/headlines/eu-weit-an-letzter-stelle-in-luxemburg-liegt-der-marktanteil-der-generika-bei-nur-5-prozent/, date accessed 21.11.20.

- Ärzteblatt. (2020): Share of generics continues to rise: available at https://www.aerzteblatt.de/nachrichten/113925/Anteil-der-Generika-steigt- more, retrieval date 21.11.20.

- EY. (2020): COVID-19: Why pharma supply chains will change: available at https://www.ey.com/de_de/covid-19/corona-krise-pharma-lieferketten-anpassen, accessed 21.11.20.

- Pro Generika e.V. (2020): Where do our active pharmaceutical ingredients come from? - A world map of API production, Final report, available at https://progenerika.de/app/uploads/2020/11/API-Study_long-version_EN.pdf, retrieval date 03.12.20.

- Schnur, T. (2020): Nachhaltigkeit von Pharma Supply Chains, CHEManager, 14.07.20, available at https://www.chemanager-online.com/news/nachhaltigkeit-von-pharma-supply-chain, retrieval date 03.12.20.

- Rickwood, S. (2020): Nine trends in the pharmaceutical market 2020, market access & health policy, 03/2020, available at https://www.iqvia.com/-/media/ iqvia/pdfs/germany/publications/articles-in-der-fachpresse/article-trends-im-pharmamarkt-2020-mai20.pdf?la=en&hash=4150731465094D326F4D218B41972E25, retrieved 03.12.20.

- Ärzteblatt (2020): Anteil der Generika steigt weiter, Ärzteblatt, 19.06.20, available at https://www.aerzteblatt.de/nachrichten/113925/Anteil-der-Generika-steigt-weiter, retrieval date 03.12.20.

- Heinzer, M. (2020): Biomanufacturing der nächsten Generation, Plattform Life Sciences, September 2020, available at https://www.goingpublic.de/wp-content/uploads/epaper/2020-3-LS/#36, retrieval date 03.12.20. en/wp-content/uploads/epaper/2020-3-LS/#36, retrieval date 03.12.20.

- Pro Generika e.V. (2020): Zahl des Monats Februar: 46 Cent für Tagesdosis Antibiotika, available at https://progenerika.de/zahl-des-monats/zahl-des-monats-2020-februar/, retrieval date 25.11.20.